Canada Tax Increase 2025

Canada Tax Increase 2025 - Tax Changes in Canada for 2023 RRSP, TFSA, FHSA and More Blog, Higher tax brackets thanks to inflation canadians’ marginal tax rates are set for a sizeable. Updated april 17, 2025 3:41 pm. Complete Guide to Canadian Marginal Tax Rates in 2025 Kalfa Law, Updated april 17, 2025 3:41 pm. Your taxable income is your income after various deductions, credits, and exemptions have been applied.

Tax Changes in Canada for 2023 RRSP, TFSA, FHSA and More Blog, Higher tax brackets thanks to inflation canadians’ marginal tax rates are set for a sizeable. Updated april 17, 2025 3:41 pm.

If you file on paper , you should receive your income tax package in the mail by this date.

The federal government is raising the mandatory canada pension plan and employment insurance contributions in 2025.

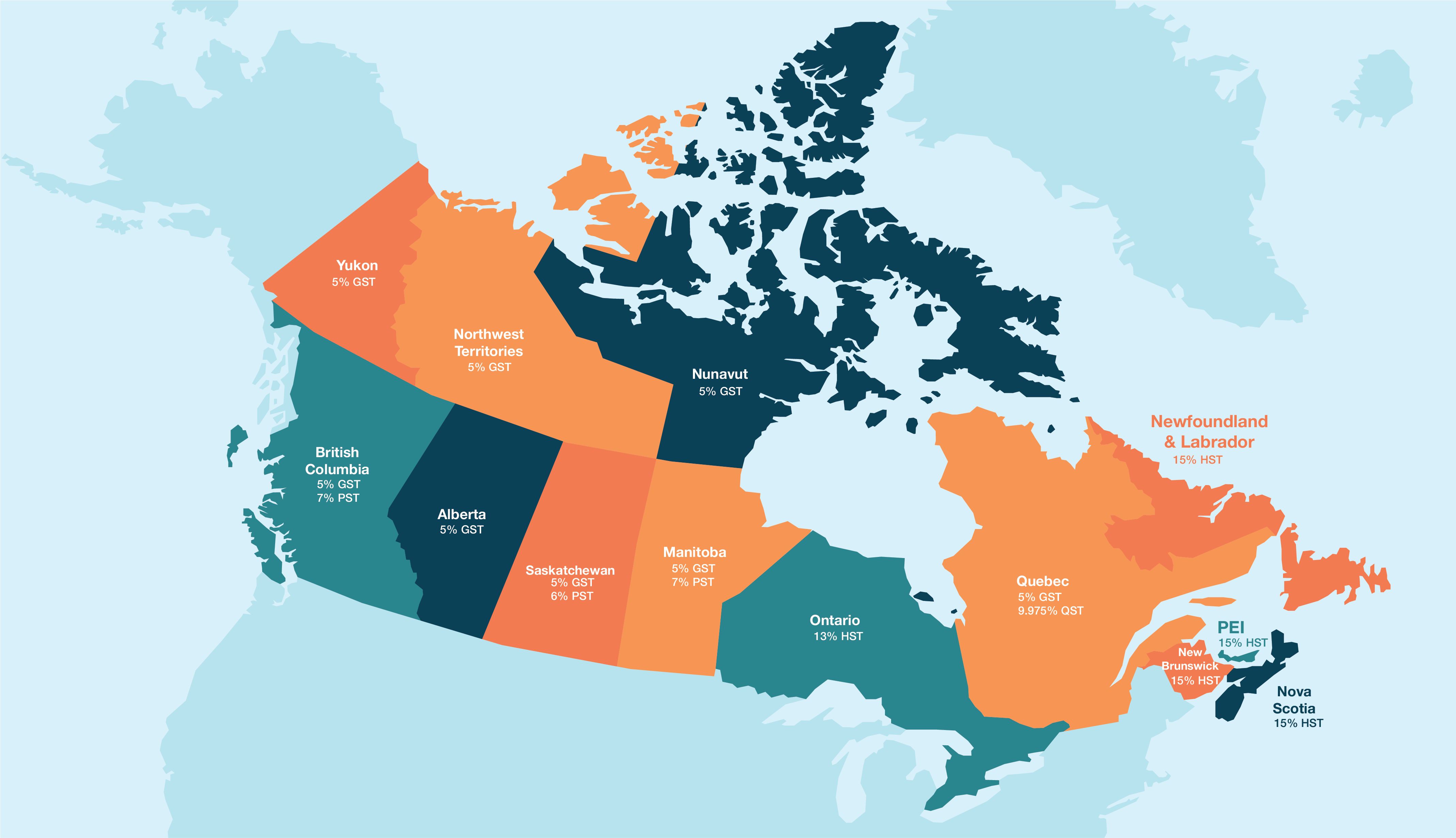

Canadian Provincial Taxes, Canada Province Tax Rates, GST, PST, HST, These rates apply to your taxable income. The federal government is raising the mandatory canada pension plan and employment insurance contributions in 2025.

Tax Changes In Canada for 2025 CPP Increase, TFSA, and more!, Budget 2023 announced certain upcoming changes for the 2025 tax year. Canada 2025 and 2023 tax rates & tax brackets.

Canada Tax Increase 2025 New Tax Slab & Know Expected Changes?, Budget 2025 proposes an increase in taxes on capital gains on the wealthiest 0.13 per cent. They will each pay $3,867, marking a $113 increase from the previous year for earnings of $68,500 or more.

So for the first $250,000 in capital gains, an individual.

Canada 2025 and 2023 tax rates & tax brackets. Basic personal exemption amounts have also.

Canada Tax Increase 2025. Except as otherwise noted, all statutory references in this publication are to. The federal tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.047 (a 4.7% increase).

Canadian Sales Tax Registration Requirements Crowe Soberman LLP, For workers making $73,200 or more, federal payroll taxes (cpp and ei tax) will cost them $5,104 in 2025. See indexation of the personal income tax system for how the indexation factors are calculated.

Importantly, your provincial or territorial rate is determined by the province/territory you are living in on december 31 of the tax year.